Meltblown fabric Production Chain Behind China Inferior Masks

By For Safer Imports • 07/19/2021 • No Comments

As the epidemic continues, the problem of China inferior mask has begun to emerge. If allowed to develop, inferior masks will bring disaster to the country and the people. Not only does it bring great potential safety hazards to the public’s self-protection, it will also disrupt the entire industrial chain of mask supply and smash the brand of “Made in China”.

To this end, the Chinese government department took decisive steps. In early April, Beijing seized 120,000 inferior masks. On April 9, Hubei Xiantao also destroyed more than 1 million unqualified masks. On April 11, the relevant departments of Yangzhong city, a major producer of melt-blown fabric, announced that middlemen were forbidden to hype up and no “three noes” melt-blown fabric products were found. “Double the price in three days” and “Return investment in seven days” are precisely driven by such huge interests, which eventually led to batches of China inferior mask flowing to the market and even out of the country.

The industrial chain behind China inferior mask

Behind China inferior mask, there is a complete industrial chain. In order to make huge profits, some enterprises have replaced meltblown fabric, the most critical core filter material in masks, with inferior meltblown fabric with poor protection effect. Plus during mask inspection the most important part is meltblown fabric inspection, but meltblown fabric inspection is more difficult, only professional laboratories can do it, and the fees are more expensive. Many mask manufacturers are unwilling to pay for it, resulting in more and more inferior masks entering the market.

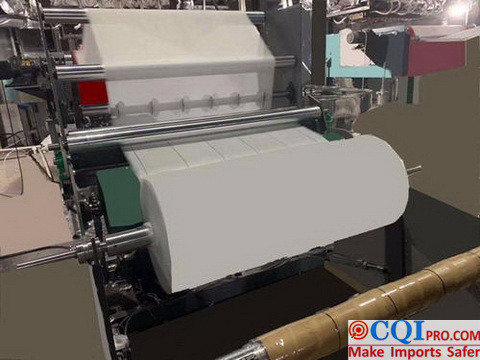

Many so-called inferior melt-blown fabrics are cheap polypropylene fiber materials, which replace melt-blown fiber materials, and a small melt-blowing machine of RMB 300,000 each, which replaces nearly RMB 10 million of professional melt-blown fabric equipment. In the end, what is produced is inferior meltblown fabric without meltblown fabric electret, and the filtration efficiency is only 40% to 50%.

And it is precisely because of the disruption of inferior meltblown fabric that China inferior mask become popular in the market, pushing the entire industrial chain into chaos recently, with chemicals such as polypropylene and propylene, including its upstream raw materials, soaring all the way. Data show that the mainstream transaction price in the propylene market was 5900-5950 yuan/ton on April 10 and rose to 8000 yuan/ton on the 12th.

Under the influence of the soaring price of propylene, the downstream industry suffered a total loss. At a price of 8,000 yuan, Propylene oxide lost 550 yuan per ton, n-butanol lost 1650 yuan, octanol lost 1800 yuan and acrylonitrile lost 4200 yuan. … Even, some enterprises began to sell propylene originally used as raw material. For normal melt-blown fabric, 1500 melt-blown materials specially used for melt-blown fingers need to be added with electrifying masterbatch and electrifying process to further improve filtration efficiency. Disadvantages are large equipment investment, long production cycle and high price of melt-blown special materials. However, driven by huge profits, these problems are no longer problems.

As of April 14, there were still people selling meltblown fabric production lines online, with prices ranging from 300,000 yuan to 400,000 yuan each. For example, a medium-sized meltblowing machine production equipment of a protective equipment company in Hunan costs 450,000 yuan and produces 100 to 300 kilograms of daily output. “The package will be delivered in 20 days at the earliest.” The raw material is not a problem either. The special melt blown material has high price and is replaced by polypropylene ordinary fiber material. “Two weeks ago, the price of PP fiber for producing inferior meltblown fabric was 7,000 yuan/ton, and the price of meltblown grade PP was 60,000 yuan/ton, and no goods were available.” Analysts said. However, on the 14th, according to feedback from Shenzhen melt-blown fabric distributors, special materials are still available at present, but the price has risen to 80,000 yuan/ton. “Small workshops don’t want to use this because the price is too high, but use Shenhua 2040 grade materials.” Although Shenhua 2040 brand fiber material also rose from 7000 yuan/ton two weeks ago to 25000 yuan/ton, it undoubtedly has obvious advantages over 80,000 yuan/ton special material.

It should be pointed out that the cost of small workshops can also be reduced by about 10,000 yuan per ton if no electret processing is carried out. Meltblown fabric produced by cutting corners has coarser fibers and worse barrier effect, which cannot achieve the protective effect of normal meltblown fabric. At the same time, meltblown fabric also has less electrostatic adsorption function due to no electrifying treatment. The ability of such inferior masks to isolate viruses and bacteria is greatly reduced.

The market price of inferior meltblown fabric is 350,000-600,000 yuan/ton, which is enough to make many people abandon the principle and take risks. Assuming the initial equipment investment is 400,000 yuan, the cost of using 2040 fiber materials is 37,500 yuan per ton of raw materials, the daily output is 200 kg, and the product price is 350,000 yuan, it is not a dream to return investment in one week.

In the past period of time, inferior meltblown fabric overturned the entire propylene industry chain by itself. Before the Qingming Festival, even though masks were in short supply and various regions were continuously increasing their production capacity, the price of polypropylene did not fluctuate significantly before the Qingming Festival due to the small proportion of high melting polypropylene fiber in the downstream consumption area of polypropylene and the fact that the product itself was in an oversupply state. However, when the inferior meltblown fabric manufacturers entered, the prices of the above-mentioned fiber materials such as Shenhua 2040 brand began to skyrocket,and the manufacturers began to switch to fiber materials accordingly. After the limited production capacity was transferred to fiber materials, the production capacity of another polypropylene product, drawing materials, was also affected. Data show that the current output of polypropylene drawing materials has dropped to a new historical low of 20.69%.

As wiredrawing materials are more widely used, the price rise of this product is inevitable. Among them, Shandong region saw the biggest increase, and propylene prices in eastern and northeastern regions also rose to varying degrees. However, the operation of the entire industrial chain is just like a gear plate tightly engaged, and the occurrence of a problem in one link will cause a systematic failure. The change of polypropylene is further transmitted to the upstream product propylene. Unfortunately, the upstream crude oil market has not been peaceful recently, and international oil prices have rebounded under the promotion of the news of production reduction.

The price of propylene exploded as both ends squeezed. However, the industry said that propylene prices do not have the basis to continue to rise. With the increase in inventory pressure of production enterprises, and many head manufacturers have also taken the initiative to cool the industry in recent days to curb the hype.In addition, the Chinese government strictly inspects low-quality mask enterprises, so there is a greater chance that propylene prices will fall back to normal levels after a period of time, possibly around the end of April and the beginning of May. In addition, on April 13, PetroChina and Sinopec suspended the intermediate trade billing link for high melt index fibers, with the sales company directly connecting customers and setting a maximum sales price of 11,500 yuan/ton to control the market hype atmosphere from the source.

This article is an original article for CQI Inspection, who is committed to providing high-quality product inspection technology and know-how sharing for global importers and retailers to make imports safer.

All rights reserved. The contents of this website provided by CQI Inspection may not be reproduced or used without express permission.

For reprint, please contact with CQI Inspection, thank you.

For Safer Imports

Search

Catalogue

Recent Post

- CQI Inspection Report

- Folding Table: Technological Comparison Between Two Factories

- Tear off the Label Made in China of “Good Quality and Low Price”, Don’t Spoil the International Market

- Do You Know Those Important Material Tests for Car Floor Mats ?

- In 3 Months, Furniture Maker Improves Quality So Much, But Why…

2543 2607 2659 2667 2676 2682 2683 2685 2687 2692 2693 2699 2700 2705 2708 2714 2715 2716 2743 2744 2746 2748 backpack defect check Children furniture quality control China disposable medical gloves Electric toothbrush cost Electric toothbrush inspection Electric toothbrush waterproof inspection Electronic scale quality inspection Glove testing consultation infrared thermometer testing consultation Lighter inspection Lighter process inspection Mask inspection nitrile gloves inspection Pajamas process inspection Plastic clip quality check Quartz watch inspection Quartz watch process inspection Sofa bed inspection solid flooring inspection stainless steel quality control Umbrella process inspection Wenzhou shoes inspection Zhangzhou watch inspection

BLOG

- CQI Inspection Report

- Folding Table: Technological Comparison Between Two Factories

- Tear off the Label Made in China of “Good Quality and Low Price”, Don’t Spoil the International Market

- Do You Know Those Important Material Tests for Car Floor Mats ?

- In 3 Months, Furniture Maker Improves Quality So Much, But Why…